- March 20, 2020

- Posted by: Kieran Moloney (Ottawa)

- Category: COVID19

IMPORTANT: The federal government has announced a series of new programs that serve as income replacements for Canadians during this ongoing pandemic. It is important to note that Canadians can only apply and be receiving financial support form one of these programs at any given time. Whether it be the CERB, CEWS, or EI, Canadians can only apply to one of these benefits. If you apply or receive more than one the government has indicated that you will be required to pay those monies back.

Due to the concerns from Service Canada staff regarding their health and safety, all Service Canada offices will be closing to the public. Agents will still be working inside but will be working on the phones and online.

FIND OUT WHAT FINANCIAL SUPPORT YOU CAN CLAIM BY CLICKING HERE

The new Emergency Response Benefit (CERB)

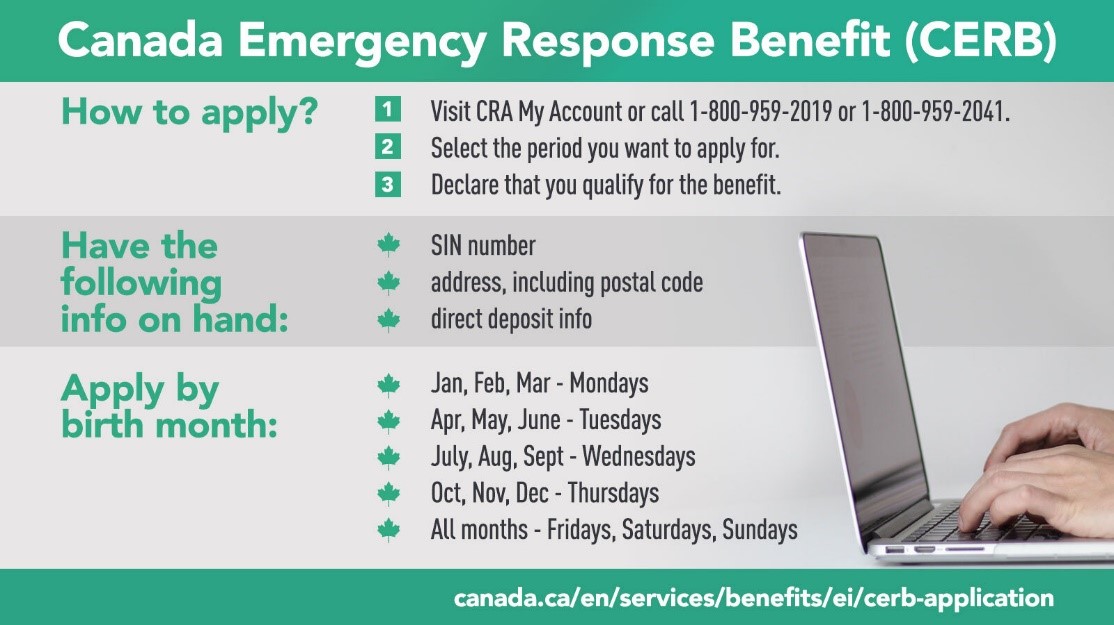

If you stopped working because of COVID-19, the Canada Emergency Response Benefit (CERB) may provide you with temporary income support. The CERB provides $500 a week for up to 16 weeks. Any EI applications after March 15 where the applicant is also eligible for CERB will be automatically moved over to CERB.

UPDATE: On June 16th, the federal government announced that the Canada Emergency Response Benefit program will be extended by eight weeks (until the end of November.

As of June 4, the federal government has spent a total of $43.5 billion sending more than 8.4 million Canadians the $2,000 monthly payments.

Eligibility for CERB

The benefit will be available to workers:

- ♦ Residing in Canada, who are at least 15 years old;

- ♦ Who have stopped working because of COVID-19 and have not voluntarily quit their job;

- ♦ Did not apply for, nor receive, CERB or EI benefits from Service Canada for the same eligibility period;

- ♦ Who had income of at least $5,000 (employment income, self-employment income, or provincial/federal benefits related to maternity or paternity leave) in 2019 or in the 12 months prior to the date of their application; and

- ♦ Who are or expect to be without employment or self-employment income for at least 14 consecutive days in the initial four-week period. For subsequent benefit periods, they expect to have no employment or self-employment income.

On April 15, the government announced changes to the eligibility rules to:

- ♦ Allow people to earn up to $1,000 per month while collecting the CERB.

- ♦ Extend the CERB to seasonal workers who have exhausted EI regular benefits and are unable to undertake regular seasonal work as a result of COVID-19.

- ♦ Extend the CERB to workers who have recently exhausted their EI regular benefits and are unable to find a job or return to work because of COVID-19.

The changes announced on April 15 will be retroactive to March 15, 2020. More details will be posted on the CRA portal shortly.

You can apply for the CERB through My CRA now.

There are two ways to apply:

For those receiving dividends, you are eligible to claim CERB if the dividends are “non-eligible dividends” (generally, those paid out of corporate income taxed at the small business rate).

If this benefit runs out (after 16 weeks) and a worker is still unemployed and EI eligible, they can apply for EI.

*New- Existing applications to EI that are not processed by the time the CERB opens up will be automatically transferred to the CERB. Applications to EI processed before that time will result in the applicant receiving EI benefits.

| An employer has questions regarding their obligations to their employees. |

| Visit https://www.cfib-fcei.ca/en/tools-resources/covid-19-coronavirus-business for more detailed information on best practices for employers

|

| Can an individual work or collect any income while collecting the Canada Emergency Care Benefit (CERB)? |

| A worker can earn up to $1000 a month and retain CERB eligibility. This $1000 includes employment income, self-employment income, tips, and royalties. It does not include Pensions or student loans.

|

| Do I have to be laid off to collect CERB? |

| If your employment income has been reduced to under $1000 due to COVID but you are still officially employed, you can be eligible.

|

| I would be making more than $500 a week on EI, but CERB only pays me $500. Can I get back on EI or get more money? |

| No. Every EI applicant after March 15th will be on CERB, and that will mean some end up with less than they would receive on EI. We have been aware of this since the beginning and Employment Shadow Minister Dan Albas has sent correspondence to the Minister asking for more information on this topic. Those people who are EI eligible will be able to apply for EI after the CERB runs out as long as they are still unemployed.

|

| Can I collect CERB if I was supposed to start a job but that job is not going to happen due to COVID? |

| Maybe. If you have exhausted your regular EI benefits after December 29, 2019 and now cannot find work you may be eligible for CERB as long as you meet the other eligibility criteria. FYI we maintain that this change is not in line with the law and should need a legislative change. However, currently the applications allow for this and so people should follow the rules and apply if they believe they are eligible |

Issue of Potential Double Payments

For the stream of clients who applied for benefits through Service Canada/EI since March 15, the department is leveraging the existing EI payment systems to deliver CERB payments to these clients. To ensure timely payment to these clients, the approach for these clients is as follows:

All clients who meet the CERB criteria (regular and sickness benefit applicants, with a claim that start March 15th onward) are being provided with an initial payment of $2,000

Going forward, these clients should continue to complete their bi-weekly reports.

These bi-weekly reports act as the means by which clients indicate their continued need for the benefit

The system will then ensure that combined, these clients will receive the equivalent of 16 weeks of benefits at $500 per week for a total of $8,000.

As a result of this approach, clients with a claim established March 15 or March 22 and who have already completed their regular bi-weekly reports may have received both the $2,000 initial payment and $1,000 based on the cards they submitted

Apply for Employment Insurance

*New- Existing applications to EI that are not processed by the time the CERB opens up will be automatically transferred to the CERB. Applications to EI processed before that time will result in the applicant receiving EI benefits (see above).

NOTE: When doing your bi-weekly update for EI please do it on the scheduled date as per the instructions form Service Canada. Filling in your update report too early or too late may result in your account becoming locked and having to call the Service Canada 1-800 number. These wait times are several hours long.

If you were recently laid off or have reduced hours and qualify for Employment Insurance benefits, you can submit your request today.

If you are eligible, visit the EI sickness benefits page to apply.

Information for Alberta employees and employers

Mortgage and Rent Supports

For renters: Alberta is banning evictions for renters until at least May 1 and freezing rent increases to help counter some of the worst social and economic impacts of COVID-19. As a first step, contact your landlord to see what supports are available to you.

For homeowners: The Canada Mortgage and Housing Corporation (CMHC) and other mortgage insurers offer tools to lenders that can assist homeowners who may be experiencing financial difficulty. These include payment deferral, loan re-amortization, capitalization of outstanding interest arrears and other eligible expenses, and special payment arrangements. The Government, through CMHC, is providing increased flexibility for homeowners facing financial difficulties to defer mortgage payments on homeowner CMHC-insured mortgage loans. CMHC will permit lenders to allow payment deferral beginning immediately. Further, many Canadian banks have announced that they will be allowing Canadians to defer their mortgage payments for 6 months. As a first step, contact your lender to see what supports are available to you.

I am a senior, what financial supports are being put in place for me?

The government has proposed to reduce the required minimum withdrawals from Registered Retirement Income Funds (RRIFs) by 25% for 2020, in recognition of volatile market conditions and their impact on many seniors’ retirement savings. This will provide flexibility to seniors that are concerned that they may be required to liquidate their RRIF assets to meet minimum withdrawal requirements. Similar rules would apply to individuals receiving variable benefit payments under a defined contribution Registered Pension Plan.

The Government is proposing to provide a one-time special payment by early May 2020 through the Goods and Services Tax credit (GSTC). This will double the maximum annual GSTC payment amounts for the 2019-20 benefit year. The average boost to income for those benefitting from this measure will be close to $400 for single individuals and close to $600 for couples.

How does COVID-19 impact my personal or business tax filings?

For individuals (other than trusts), the return filing due date will be deferred until June 1, 2020. However, the CRA encourages individuals who expect to receive benefits under the GSTC or the Canada Child Benefit not to delay the filing of their return to ensure their entitlements for the 2020-21 benefit year are properly determined.

For trusts having a taxation year ending on December 31, 2019, the return filing due date will be deferred until May 1, 2020.

“You will not be charged late-filing penalties or interest if your 2019 individual (T1) income tax returns are filed and payments are made prior to September 1, 2020. However, the government is preserving the June 1 filing deadline for T1 individuals, and the June 15 filing deadline for T1 self-employed individuals (sole-proprietors), in order to encourage filing returns in time to accurately calculate benefits, which rely on 2019 tax returns for entitlement calculation.”

So although the official filing date has not been deferred, they will not be charging interest on any late payments between the filing date of June 1 and September 1.

Job-protected leave

Changes to the Employment Standards Code will allow full and part-time employees to take 14 days of job-protected leave if they are required to self-isolate or caring for a child or dependent adult that is required to self-isolate

To be eligible, employees will not be required to have a medical note and do not need to have worked for an employer for 90 days.

This leave covers the 14-day self-isolation period recommended by Alberta’s chief medical officer. This leave may be extended if the advice of the chief medical officer changes.

The leave does not apply to self-employed individuals or contractors.

Increasing the Canada Child Benefit

Eligible recipients will receive $300 more per child with their regular May CCB payment.

If you have previously applied for the CCB, you do not need to re-apply.

For more information on the Canada Child Benefit such as how to apply and eligibility requirements, go to Canada child benefit or call 1-800-387-1193.

https://www.canada.ca/en/employment-social-development/corporate/notices/coronavirus.html

Extra time to file income taxes

The government is deferring the filing due date for the 2019 tax returns of individuals.

For individuals (other than trusts), the return filing due date will be deferred until June 1, 2020.

The government will allow any new income tax balances due, or instalments, to be deferred until after August 31, 2020 without incurring interest or penalties.

Note: If you expect to receive benefits under the Goods and Services Tax credit or the Canada Child Benefit, we encourage you to not delay your 2019 return filing to ensure that your entitlements are properly determined.

TEMPORARY SALARY TOP-UP FOR LOW-INCOME ESSENTIAL WORKERS

The federal government will work with provinces and territories through a new transfer to cost-share a temporary top up to the salaries of low-income workers (those who earn less than $2,500 per month on a full time basis), that the provinces and territories have deemed essential in the fight against COVID-19.

This will provide a much needed boost to those on the front-line in hospitals, those caring for seniors in long-term care facilities, those working so hard to make sure that there that is food on our shelves and tables, and others.

More details will be released shortly.

Canada Emergency Business Account (CEBA)

On May 20th, the federal government announced an expansion to the eligibility criteria for the Canada Emergency Business Account (CEBA) to include many owner-operated small businesses.

The changes to the CEBA will allow more Canadian small businesses to access interest free loans that will help cover operating costs during a period when revenues have been reduced, due to the pandemic.

The program will now be available to a greater number of businesses that are sole proprietors receiving income directly from their businesses, businesses that rely on contractors, and family-owned corporations that pay employees through dividends rather than payroll.

To qualify under the expanded eligibility criteria, applicants with payroll lower than $20,000 would need:

- • a business operating account at a participating financial institution

- • a Canada Revenue Agency business number, and to have filed a 2018 or 2019 tax return.

- • eligible non-deferrable expenses between $40,000 and $1.5 million. Eligible non-deferrable expenses could include costs such as rent, property taxes, utilities, and insurance.

Expenses will be subject to verification and audit by the Government of Canada. Funding will be delivered in partnership with financial institutions. More details, including the launch date for applications under the new criteria, will follow in the days to come. To date, over 600,000 small businesses have accessed the CEBA, and the government will work on potential solutions to help business owners and entrepreneurs who operate through their personal bank account, as opposed to a business account, or have yet to file a tax return, such as newly created businesses.

Increased Goods and Services Tax Credit

The government is providing a one-time special payment by early May through the Goods and Services Tax credit for low- and modest-income families.

The average additional benefit will be close to $400 for single individuals and close to $600 for couples.

There is no need to apply for this payment. If you are eligible, you will get it automatically.

Support for students

Canada Emergency Student Benefit.

The Canada Emergency Student Benefit (CESB) provides financial support to post-secondary students, and recent post-secondary and high school graduates who are unable to find work due to COVID-19. This benefit is for students who do not qualify for the Canada Emergency Response Benefit (CERB) or Employment Insurance (EI).

Canada Summer Jobs program

The government has announced temporary changes to the Canada Summer Jobs program that will help employers hire summer staff and provide young Canadians access to the jobs they need during this unprecedented time. This program will help create up to 70,000 jobs for youth between 15 and 30 years of age.

Interest-Free Student Loans

Effective March 30, the government is placing a six-month interest-free moratorium on the repayment of Canada Student Loans for all student loan borrowers. No payment will be required and interest will not accrue during this time.

Support for Canadians with Disabilities

On June 5th, the federal government announced support to help Canadians with disabilities deal with extra expenses during the COVID-19 pandemic. This support includes a special one-time, tax-free payment to individuals who are certificate holders of the Disability Tax Credit as of June 1, 2020, as follows:

✓ $600 for Canadians with a valid Disability Tax Credit certificate.

✓ $300 for Canadians with a valid Disability Tax Credit certificate and who are eligible for the Old Age Security (OAS) pension.

✓ $100 for Canadians with a valid Disability Tax Credit certificate and who are eligible for the OAS pension and the Guaranteed Income Supplement (GIS).

Combined with the special payments of $300 for Canadians who are eligible for the OAS pension and the additional $200 for those eligible for the GIS, all seniors with a valid Disability Tax Credit certificate will receive a total of $600 in special payments. People who are eligible for this special payment will receive it automatically.

Support for expectant mothers

As part of the CERB process, applicants are asked if they are pregnant and anticipating going on maternity/parental benefits. This is to ensure that claims are properly established, and to ensure a smooth transition over to maternity/parental at the appropriate time without having to re-apply.

However, there was a limitation within the government’s CERB system when expectant mothers disclosed they were pregnant: women were being immediately put on EI benefits even if they should have been on the CERB. This was happening regardless of whether the expectant mother became eligible for EI before or after March 15th.

As of May 8th, expectant mothers who should have been receiving the CERB will have their claims converted retroactively to the CERB. Those who had been receiving less than the $500 per week will receive a payment to get them up to the $500. Those who had been receiving more than the $500 per week will not have any money clawed back, but will receive the $500 per week flat rate from the time their claim is converted going forward. The weeks for which they collect the CERB will not impact the number of weeks of maternity and parental benefits they may receive.

To reiterate, we will ensure that expectant mothers affected by this are not disadvantaged and receive their full entitlement of weeks for their future maternity/parental claim – any weeks where they received regular EI benefits when they should have been receiving CERB will be put back onto their account and they will have those weeks available to them when needed once their child is born.

Additional Resources

General COVID-19 Federal Program Information: https://www.canada.ca/en/department-finance/economic-response-plan.html

CRA Measures: https://www.canada.ca/en/revenue-agency/campaigns/covid-19-update.html

CERB Application: https://www.canada.ca/en/revenue-agency/services/benefits/apply-for-cerb-with-cra.html

CERB FAQs: https://www.canada.ca/en/services/benefits/ei/cerb-application/questions.html

Business Credit Availability Program (BCAP): https://www.canada.ca/en/department-finance/programs/financial-sector-policy/business-credit-availability-program.html

COVID-19 Business Calculator (determine which you are eligible for): https://innovation.ised-isde.canada.ca/s/?language=en